Conman Extraordinaire Shmuel

By Frank Parlato

|

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

This week we return to the extraordinary conman Shmuel Shmueli, who defrauded dozens of local lawyers along the way to making me his chief victim. Born April 9, 1951, in Israel, Shmueli came to the US decades ago. He uses several aliases and has made the religious claim to be “Shmuel Shmueli Representative of the Lubavitcher Rebbe For matters on Our Land of Israel.” The title – which he bestowed on himself – is a claim to leadership of the Hassidic Chabad sect of Judaism, a claim which is uncorroborated by any member of the Hassidic community. Shmueli, assuming an air of piety, informs those he does business with that he adheres to a Kosher diet and never works on the Sabbath or Jewish holidays. In our preceding article, we traced how Shmueli formed a weekly Hebrew newspaper in Brooklyn, Israel Shelanu (Our Israel) which closed after Haaretz Daily Newspapers and Maariv Modiin Publishing Co. sued him for plagiarizing their work. They won a $24 million judgment against Shmueli. Shmueli, discharging the $24 million judgement in bankruptcy, never paid a penny. He also discharged the debts to his lawyers on the case, Moskowitz and Book, Andrew Paul Cooper and Jon Lefkowitz, as well as his newspaper employees and vendors to the tune of some $400,000. As a strong reflection of his religious sincerity, hhe included the Wisconsin Institute of Torah Studies in his bankruptcy avoiding a payment of more than $3000 the school claimed was due. Last week we also detailed how Shmueli bought a home in Brooklyn then sold it to his wife, who sold it back to him, who sold it back to his wife, who sold it to his daughter – each time raising mortgage money against the home. Finally his daughter sold the house for almost $500,000 to a couple who planned to live there. After they paid for it, Shmueli told the couple they could not move in because he had a lease from his daughter guaranteeing him the right to stay in the house. The couple sued in Federal Court; Shmueli lost, was evicted, and federal marshals removed him. The court awarded the couple a $56,669 judgment for legal fees and losses occasioned by Shmueli’s fraudulent lease. But Shmueli, never paid a dime since he discharged that judgment in bankruptcy, as well. After losing his home and his newspaper and his wife, Shmueli wound up in Niagara Falls where I had the misfortune to meet him.

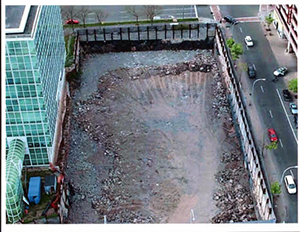

The “billionaire” David Ho Sets the TableWhile Shmueli was in Brooklyn conning people, a Hong Kong businessman named David Ho commenced a development in Niagara Falls called AquaFalls. Ho’s bio lists him as the founder of Caltex South China Investments Limited, a "petroleum firm" with ties to Chevron-Texaco. In addition Ho sat on the boards of a number of companies that raised investor capital and lost investors' capital. Ho described himself as a “billionaire” when he promised the $65 million AquaFalls underground aquarium would be built 200 feet from the entrance of the Niagara Falls State Park. The project, announced to great fanfare in July of 1999, was described as an oceanographic experience where spectators could view the sea through a series of glass tunnels. Gov. George Pataki arrived for the ground breaking and many locals, including the mayor, heralded the development. The Niagara County IDA granted AquaFalls' tax-exempt status. After securing approval from the Army Corp. of Engineers, Ho hired Ciminelli Construction to blast the 40 foot deep, one acre hole into bedrock in front of the old Occidental Chemical building, a mere 900 feet from the brink of the American Falls. Yet somehow “billionaire” Ho could not get financing to build his aquarium. In fact he could not even pay for the hole and one of his partners, Niagara Falls businessman, Harry Williams, arranged for Ho to obtain a $2 million loan from local developer Larry Reger.

A Hole is a Hole is a HoleWhen I was introduced to Ho by his lawyer, Gregory Davis the hole was already five years old. The Buffalo News described it in news stories, as, “The locally infamous hole in the ground, dug in front of the former Occidental Chemical Center in 1999, has never been filled with anything, much less the …. aquarium a group of international investors promised.” And, “There's a huge hole in the City of Niagara Falls, and it needs to be filled with more than excuses…... It's the first thing drivers see when they cross the bridge from the Canadian side. They also see an aged sign on the hole-encompassing fence, trumpeting an ‘AquaFalls’ attraction that has been five unproductive years in the making.” By the time I got there, the City of Niagara Falls had taken AquaFalls to court on claims the hole was endangering the safety of pedestrians and traffic; in Nov. 2004, City Court Judge Angelo J. Morinello fined AquaFalls $192,500 for prolonged delays in remedial work to its property. As the News reported, “After five years, the 40-foot hole on Rainbow Boulevard is still not an aquarium, and the protruding metal fences and broken sidewalks around the property still trip pedestrians and force them to walk in the road” in order to get to the Niagara Falls State Park.

Reger starts foreclosingAs the hole was creating civic concern, privately, Reger, who lent the money to pay for the hole, was foreclosing. As holder of a second mortgage, his mortgage was legally junior to a $6.8 million first mortgage on the property, placed there somewhat suspiciously by Ho himself – and in Ho’s name. This meant that, if Reger foreclosed, and tried to sell the property, Ho would get the first $6.8 million of the sale price before Reger could collect his $2 million. And frankly nobody thought the property was worth anywhere near $6.8 million. Should Reger decide to keep the property, Reger could not even collect rents – since the rents were assigned to the first mortgage which was held by Ho. While Reger’s mortgage was in effect worthless, he could still foreclose, and, owning the property, he could still prevent anyone from renting it so that Ho stood to lose his first mortgage, as the property, with its giant hole, and mounting expenses, would be condemned and, ultimately, the tax man would foreclose and everyone would lose everything. In late 2004, Reger set a date for foreclosure, but he did not want to foreclose. In fact he told Ho that he would forestall foreclosure if Ho would merely make a payment of $23,000 to cover one month’s interest. The “billionaire” Ho asked me for a loan of $23,000 to stop the foreclosure. I came up with a plan. I approached Reger and negotiated with him to assign to me his $2 million second mortgage and stop the foreclosure. Then I cut a deal with Ho, moving Reger’s mortgage to first position (from second), and making Ho’s $6.8 million a second mortgage. Instead of foreclosing and getting nothing, Reger would get paid first if I could develop the vacant building with its giant hole. I next formed a partnership with Ho, saving him from foreclosure.

Ho and I form a partnershipCalled One Niagara LLC, Ho and I signed an operating agreement for a company that gave me irrevocable rights to manage the property – both the 9-story former Occidental Chemical office building and the one acre hole in front of it - with Ho having no managerial rights whatsoever - but 50 percent of the proceeds of a sale and profits after expenses. The agreement Ho signed – when he was on the verge of foreclosure – read in part: “Frank Parlato shall be the sole Manager of the Company,” with “full and exclusive right to control day to day operations and business affairs of the Company, and …. this provisions shall be broadly interpreted in favor of (Parlato) and (Parlato) shall be entitled to take any and all actions with respect the Property and the business of the Company that (he) determine(s) to be appropriate and in the Company’s best interest, in each case without any further confirmation or approval of (David Ho).” From that day forward (December 9, 2004) Ho had no more obligation to invest in the project and no managerial rights. And Ho never invested a single dime in the project from the day we formed our partnership. In return for my doing all the work and being responsible for all cash calls, the contract gave me the unilateral right to pay myself a management fee which I could set without Ho’s consent.

2005-2006 I develop the propertyDuring the next two years I rescued the old Occidental building now renamed One Niagara. I immediately filled the hole and turned it into a paid parking lot for visitors to Niagara Falls. On May 10, 2005, WBEN radio announced "(A) gaping 40-foot hole in the heart of downtown Niagara Falls is finally being filled…. The removal means a blight that greeted people as they entered the city from the Rainbow Bridge will be no more." By next spring, as it was filled, as WGRZ TV reported: "The giant pit is filled now, but what's next? Buffalo developer, Frank Parlato, says he's turning it and the adjacent building, into a giant tourist center to greet those coming into Niagara Falls, N.Y." The Gazette editorialized (5/18/07): "With the paving of the dirt lot at One Niagara it truly was an end to all signs of the failed AquaFalls project that has lingered in the city like a ghost for more than seven years. Now, Frank Parlato said he will (use) the site as a paid parking lot in conjunction with a food and souvenir attraction he will operate… on the first floor of the nine-story glass building…. (O)n this side of the border… it's a pretty big development."

Reger and I partner successfullyIn April 2006, I entered into a partnership with Reger to operate the parking lot and businesses on the first floor. By 2007 it began to be successful. I filed permits to open up the top floor at One Niagara as an observation deck to provide a panoramic view of the American falls, which the Gazetteeditorial board called a "good sign". That same week, the Buffalo News reported: "The first floor now bustles with food stands and souvenir vendors. A 40-foot excavation has been filled and is a paved parking lot that fills nearly daily." Within two years, Reger got his entire investment back ($780,000) with interest and, starting the third year, (2009) he earned pure profit with no further investment. Between the time I started the business and his death in March 2015, Reger not only got all his original investment back with interest but earned millions from a partnership which started out of a bad investment he had with Ho. Reger’s estate now enjoys a six figure annual dividend from the project I started without having a dime invested into the business. No wonder Reger’s longtime lawyer, Gregory Photiadis, wrote a letter stating that Reger was complimentary of my work with him. Along the way I created more than 60 jobs in depressed Niagara Falls, with more than 20 of them paying more than $75,000 annually and all of this was done without accepting a single dime in public subsidies.

Ho brings the kiss of death, Shmuel Shmueli, to One NiagaraBy 2007, when Shmueli entered my life, the One Niagara project was far from out of the woods. The Niagara Falls’ tourist season is only 100 days long and this 9-story, 200,000 square foot building had year round expenses. In July 2007, during a visit to the building, Ho, seeing business bustling, and possessing a disdain for Reger, objected to my partnership with Reger and demanded the deal with Reger be canceled and that he get Reger’s share. As manager of One Niagara with full authority to operate the business, I refused to cancel the deal with Reger. Ho came the next day with Shmueli, whom he stated was his agent, granting Shmueli "the right to exercise all and any legal procedures to enforce … David Ho's rights." Ho left for Hong Kong never to return to the building. By August, 2007, Shmueli was on the scene daily. It soon became apparent that, now that the project was veering from a vacant hole and a condemned building, to a successful tourist operation, Ho wanted it all. Shmueli told me that if I did not cancel the deal with Reger and make him, Shmueli, the new manager he would use Ho’s wealth to destroy the project and me personally. As we sat at a table at Denny’s across the street from One Niagara, I remember Shmueli telling me he was a member of the Israeli secret intelligence, Mossad, and how he would force me to spend $500,000 in legal expenses. “I’m going to toil you a very tiny small leetle secret you vill come to know because you is very smart Mr. Frank Parlato Jr.” Shmueli told me. “You can understand my meaning and vhut kind of a man Mr. Shmuel Shmueli is. “You have hoid of the Mossad? Vell I have steel the ability to do damages to you and your friends like Mr. Lawrence Vreger… “Now I propose you do not fight and get reed of Mr. Vreger. I voil assume his roil and ve vill be friends for I like you style very much Mr. Parlato, Jr. “If not ve fight in the court and out of the court so that you vill spend much more than you vill make in years with Mr. Lawrence Vreger. “In your store you sell the postcard picture. There are two pictures. Ve vill make you spend half million in lawyer fees or this instead you can keep in your pocket if ve move Mr, Lawrence Vreger out of the postcard picture - vich you can do as manager. Othervise you vill pay and I cannot stop the move until you are no longer manager and out of the picture postcard. This is David Ho’s demand who hired me as his agent.” Shmueli then proposed that he keep the cash proceeds from the building earned on weekdays, and I take the cash from weekends - with or without telling David Ho. When I said no to his plans, Shmueli started a campaign to disrupt operations and, over the next eight years, Shmueli was true to his word - at least as to cost: Reger and I spent more than $1.4 million to defend Shmueli’s 10 lawsuits against us.

Shmueli tries to overthrow the manager, meHe began at once. Although the operating agreement of One Niagara LLC permits only the managing member – me - to call a member’s meeting, on August 16, 2007, Shmueli called a meeting when I was out of town and in that illegal meeting demoted me to superintendent of buildings and grounds, and appointed himself as the new manager. At the rogue meeting he passed a resolution that a locksmith be empowered to enter the building and change the locks. I informed Reger of the attempt at a hostile takeover and we agreed to take action to protect our assets and commence a lawsuit. On August 30, 2007, I brought an action against Shmueli in State Supreme Court before Justice Frank Caruso and won a temporary restraining order preventing Shmueli from changing the locks to the facility. Shmueli retained the law firm of Lorenzo and Cohen LLP, which was headed up by prominent local attorney Steven Cohen. It was an odd retainer agreement for, instead of the usual hourly agreement most clients have with their attorneys, this was a flat fee agreement - for $150,000. The payment was contingent on, in Shmueli's own words: “To get F.P. (Frank Parlato) out of management position in One Niagara Building.” As mentioned in previous stories, Shmueli was to stiff each of some 25 attorneys he retained to fight me in his attempt at a hostile takeover. Lorenzo and Cohen were among the first to be cheated. In next week’s edition, we will see how Shmueli sent them an initial retainer of $40,000 then proceeded to cheat them and Steve Cohen’s subsequent law firm, Hogan Willig, out of more than $112,000 and hired four more law firms, Zdarsky, Sawicki and Agostinelli, Jaeckle Fleishmann and Mugal, Bloom and Shonn, and Anderson, and Anderson, pitting one against the other. All the while Shmueli collected fees from foreign investors who gave him money for the promise of a piece of his litigation. With Shmueli pulling the strings and calling the shots – he was soon able to dupe Ho out of his entire interest in One Niagara. Stay tuned as we report further on one of the great rascals of our area, the amazing conman, Shmuel Shmueli.

|