New York residents pay the highest average state and local taxes in the nation, averaging $9,718 per year, a whopping 39 percent higher than the national median. And if you're unfortunate enough to live in Niagara County, and Niagara Falls in particular, you're paying the highest taxes in the state.

If you're working and own property, that is. Well over half of Niagara Falls residents are on the receiving end of the equation, living on government benefits covered by those paying the nearly $200 a week surcharge imposed by the state, county and city governments for the privilege of living here.

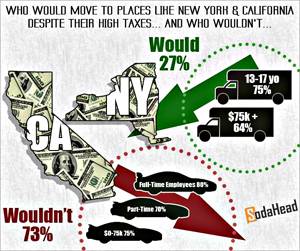

That tax burden, which is even worse for businesses than it is for individuals, is the single largest factor driving people away from New York and Niagara Falls in particular. Seriously, why would anybody who had a choice pay 39 percent more to live in a place where the weather is miserable, the crime rate is spiraling out of control and half the population is living on food stamps?

They wouldn't. Which is why the population of the city drops by around a thousand each and every year, a number that has remained fairly consistent for more than half a century. They go to Florida or North Carolina or Nevada, lured as much by the low tax rates as by the balmy weather.

Niagara Falls Mayor Paul Dyster, who claims membership in the genius society Mensa, has offered up a novel approach to the problem: He has raised or attempted to raise taxes during most of his five years in office and squandered more than $100 million in revenue from the Seneca Niagara Casino on a number of windmill tilting projects that have brought no relief whatsoever to the city's beleaguered taxpayers.

Dyster argues that the casino cash can be used only for economic development. His idea of economic development has included free rock concerts by washed up bands no one would actually pay to see, a wintertime holiday market that cost $500,000 to stage and generated no revenue whatsoever, an Underground Railroad museum that's been funded to the tune of nearly a million dollars in recent years and shows no sign of being open anytime soon and a multimillion dollar train station to serve the dozen or two Amtrack riders who come and go each day.

After spending $100 million, Dyster's economic development policies cannot lay claim to having created a single permanent, well paying job.

Apparently not occurring to the mayor despite his high IQ is an economic development approach that would almost certainly result in the immediate creation of jobs and lure hard working, taxpaying residents back to the city: Using the casino revenue to cut taxes.

Overnight, Niagara Falls could go from being perhaps the highest taxed municipality in the nation to the lowest. It would be a story the national media would eagerly cover, and entrepreneurs seeking tax relief would flock to the city from all across the country.

No longer would Seth Piccirillo, the city's community development director, have to pay recent college graduates to relocate to Niagara Falls, they'd come here on their own for the newly created jobs.

And the city's lending arm, NFC Development, would no longer need to dole out millions of taxpayer dollars to shady campaign contributors and political sycophants seeking to open saloons or remodel apartments, because private investors would be willing to put up their own cash for such enterprises, knowing they'd turn a profit.

The value of real estate, which has fallen even faster than the population numbers, would skyrocket once the onerous tax burden was lifted. No longer would the state Parole Board send registered sex offenders and other felons to Niagara Falls because of the availability of cheap housing.

All that said, what are the odds of Mayor Paul Dyster using casino cash to create a tax friendly enclave in Niagara Falls that would solve the myriad problems now confronting the city?

Slim to none, and Slim just left town.

Because Dyster doesn't trust the free market, and believes that government is the solution to, not the cause of, the social and economic problems faced by the city. A child of the 60s, he's a firm believer in the socialist concept that big government is better government, and that City Hall knows best when it comes to spending people's hard earned money.

He thinks that he and his appointees know best when it comes to developing business in the city, despite the fact that no one at City Hall has ever developed a business in real life.

So long as he is mayor, Niagara Falls will remain one of the highest, if not the highest taxed municipalities in the entire country. Hardworking taxpayers will continue to flee, and business people will continue to shun the city as though it were diseased.

Which is a shame, because it doesn't have to be that way.

|