Please click the link below to subscribe to a FREE PDF version of each print edition of the Niagara Reporter

http://eepurl.com/dnsYM9

Reassessments Back on the Table?

By: Nicholas D. D’Angelo

When the Niagara Falls City Council agenda for April 25th, 2018, was published this past week residents were surprised to find a presentation on reassessments by a representative of New York State.

The specific agenda item is a presentation by Christine Banniser, the Regional Director of New York State’s Office of Real Property Tax Services.

It was not too long ago, in 2016, that members of the Niagara Falls City Council attempted to enact a city-wide reassessment that would cost the city roughly $1 million and take two years to complete.

City Hall faced stark opposition to the idea and it was ultimately defeated.

The most recent reassessment in the City of Niagara Falls was in 2002, but there appears to be confusion about whether the process was ever completed.

Half of the city was reassessed, but as the Buffalo News reported in 2016, “a decade ago, residents in the LaSalle section of Niagara Falls led the protest against reassessments and succeeded in stopping the city from continuing annual updates before their neighborhood was adjusted.”

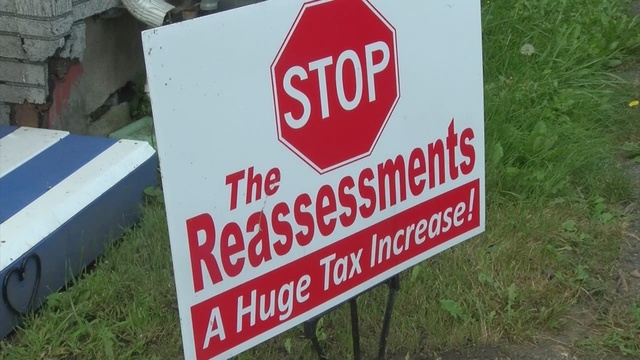

The Committee to Stop the Reassessments & Continuous Tax Increases issued the following statement on April 19th:

“Our politicians are at it again. There is going to be a representative from New York State speaking on the huge and “hidden tax increase” called “REASSESSMENTS” at the next CITY COUNCIL MEETING ON APRIL 25, 2018, at 6:00 p.m. SAVE THE DATE!

So here we go again, fighting a fight that we thought was over.

Our TAX and SPEND politicians just won’t stop trying to get more and more money from the taxpayers who already live in one of the highest taxed cities in the nation.

They should spend as much time figuring out how to reduce our taxes as they do trying to raise our taxes.

Like the wolf in with the lambs, they have taken and taken and taken until there is no more for the taxpayers to give. The wealth has been drained away from the people.

We know from experience that tax increases from reassessments are the highest tax increase that we will ever receive at one time. A tax increase from reassessments will also raise our county and school taxes as well.

We, the taxpayers, said it before and we will say it again. A reassessment will not be tolerated until the tax rate is substantially reduced so that increased assessments do not translate into increased property taxes. We are already taxed well beyond what most of us can afford.

The only thing that should be reassessed is the misuse of our money by our elected officials.”

Niagara Falls, however, is not alone in exploring the idea of a reassessment as municipalities conduct them all of the time.

In fact, Amherst, the Town of Lockport, City of Lockport, Grand Island, and Buffalo has conducted reassessments over the past few years.

Although the State of New York does not require municipalities to conduct reassessments, it does recommend they do so every three years so that property values stay consistent with changing market trends.

It is also important to note that not all taxes would go up if a reassessment were completed. Traditionally, 1/3 of residents would experience a tax increase, 1/3 would stay the same, and 1/3 would increase.

Any residents that ultimately see an increase in taxes, the exact amount is impossible to predict, would do so because their property’s present market value was significantly higher than when it was it was assessed in the past.

On the one hand, there are property owners who benefit considerably from having a drastic difference between their assessed and market value. These are people who may pay substantially less taxes than someone should for the value of their home.

On the other hand, there are property owners whose property may have lost value due to their location in the city and might pay too much in taxes.

Before the City of Niagara Falls can even think about conducting a reassessment they need to have the funds to pay for it, which, considering the city’s current deficit, they currently do not.