|

After seven and one half years of Niagara Falls Mayor Paul Dyster’s administration, the city has assumed the top spot statewide, and top 50 status nationally, in crime.

Based on FBI crime statistics, the website Mylife.com determined that Niagara Falls is the “Most Dangerous City in New York.”

NeighborhoodScout.com, which routinely ranks every American city, based on FBI crime statistics, ranked Niagara Falls the 49th most dangerous city in the USA.

Now the city has added a new laurel to its number one status: it is the highest taxed city in New York State!

Above Mayor Paul Dyster gives a short (15 minute) speech prior to a taxpayer funded concert.

Imagine if he had used the $100 million of casino cash he spent on various economic development schemes to fight crime and reduce taxes: What a city this would be today! |

|

| After seven and one half years of investing (above) more than $100 million in casino cash, Mayor Paul Dyster is now ready to turn the city over to a financial restructuring board. |

|

| The official Dyster Niagara

Falls coffee collector's edition

coffee mug: Price $100 million. |

|

|

|

|

|

|

It’s official.

The city of Niagara Falls is the highest taxed municipality in the entire state of New York.

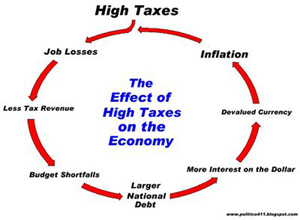

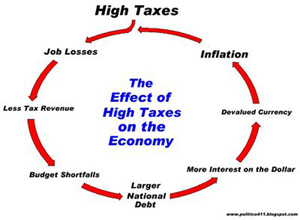

Under a complex formula used by the state’s Financial Restructuring Board for Local Governments, the various tax rates and assessment systems used by different municipalities are equalized by reducing them to the rate on the full value of all of the real property in a given jurisdiction.

In this way, apples can be compared to apples, and the true level of taxation can be determined.

According to the restructuring board, Niagara Falls represents the biggest apple in the barrel, and one that is rotten to the core.

Make no mistake. As one of the most highly taxed states in the nation, many municipalities place an undue burden on their taxpayers, exceeding the 7.05 percent rate the restructuring board deems acceptable.

A shocking number have rates of about 10 percent, and real tax rates as high as 13 or even 15 percent are not uncommon.

But the real tax rate in the city of Niagara Falls comes in at a shocking 20.2 percent, easily outdistancing the competition, according to restructuring board documents.

At Monday’s city Council meeting, former school superintendent Carmen Granto and former city councilman Frank Soda, of the city’s own Financial Advisory Panel, recommended council members pass a resolution put forth by Councilman Andrew Touma to formally invite the state board to come in and help put the city back on sound financial footing. Sources with knowledge of city finances have told the Niagara Falls Reporter that, if the city does not do something immediately, a hard control board will be imposed in the immediate future.

The NYS Financial Restructuring Board for Local Governments is a 10-member panel available year round to offer assistance to eligible municipalities. The board is chaired by state Budget Director Mary Beth Labate and includes State Comptroller Thomas Di Napoli, Attorney General Eric Schneiderman, Secretary of State Cesar Perales and six other members appointed by the Gov. Andrew Cuomo. Of these six appointees, one is recommended by the state Senate, and one is recommended by the Assembly.

The board is authorized to offer grants and loans of up to $5 million through the Local Government Performance and Efficiency Program to targeted municipalities willing to undertake certain recommendations. If the municipality agrees to accept the money then it must undertake the board’s recommendations and becomes contractually obligated to fulfill those terms.

The state board specializes in the thorny process known as binding arbitration. If a municipality is eligible for binding arbitration with a municipal union such as the police, fire and Steelworkers unions here, the municipality board serve as its binding arbitration panel and make a determination that would be final and binding on the municipality and municipal union.

Executive Director of the New York State Conference of Mayors Peter A. Baynes, said the expensive mandate known as binding arbitration, which was originally enacted as a two-year experiment in 1974 but has been deemed a sacred cow ever since, blindly ignores the fiscal ability-to-pay of local taxpayers and has arbitrarily inflated the cost of police and fire contracts in every region of this state.

Labor costs, many of them in the form of retirement benefits paid to former city workers and officials, currently consume 80 percent of Niagara Falls’ city budget.

Another specialty of the restructuring board is the consolidation of services, particularly those of police and fire departments.

“I've always been of the point of view that we need to do more with incentives to promote sharing of services and sharing of functions,” DiNapoli said. “You can do that without getting into the landmine you have with the issue of outright consolidation of jurisdictions.”

Granto said the city’s structural deficit will not be remedied by tax revenue and budget cuts, but will have to be addressed from multiple angles.

“That doesn’t mean we don’t deliver services, we deliver them in a different way,” Granto said.

Soda said the practice of including the city’s fund balance – the amount the city actually has in savings from all revenue sources – into the annual budget constitutes questionable fiscal policy at best.

“I don’t know how long that can last,” he said.

One variable in the city’s financial future is the New York State Tribal Compact, which governs casino money allocated to the city. The compact has been extended until 2023, but the rules that govern the city’s slice will be up for renegotiation next year.

Every mayoral candidate except Mayor Dyster has said they will demand a greater share of the revenue from the state.

Dyster who supports Gov. Cuomo’s extension of the compact for 10 more years in 2013 without stakeholder’s input, is, if reelected, expected to defer to Gov. Cuomo’s wishes in the matter.

Granto said that the city cannot rely on “one-shot” revenues, such as casino funding, that can fluctuate in the future. He also emphasized the state mandates the budget is subject to, noting that during his time with the Niagara Falls Board of Education, some 88 percent of their expenditures were dictated by higher government.

Soda added that a long term timeline for the Niagara County Industrial Development Agency would be beneficial in order to assess when developers’ properties will be fully taxable entities. He identified a cycle of buying property, applying for tax abatements, known as payment-in-lieu-of-taxes or PILOTs, then selling that property to another individual who reapplies. This may assist industry clusters but does not benefit city coffers in times of financial stress, he said.

“Those properties sometimes never go on the tax rolls, they’re perpetual PILOTs,” Soda said.

Councilman Charles A. Walker, who has not paid his property taxes on his own home for years and failed to file proper campaign disclosures with the NYS Board of Elections for more than a decade, voted for the restructuring plan, but said there are things the Falls can do on its own.

“Unfortunately, that’s not happening,” Walker said, “and obviously, the way it seems, it’s probably not going to happen.”

Councilman Glenn A. Choolokian was the only council member to vote against joining the state program.

Choolokian who is running for mayor said he believes that with nearly $20 million in casino revenue coming in annually, the city is not distressed, but mismanaged.

Last year after the mayor was 37 days late presenting the budget – conveniently presenting it after the November election, the Dyster rubber stamp council approved a property tax increase and a 6.5 increase in spending, while threatening layoffs to city employees.

Meantime the council – with the exception of Choolokian and Robert Anderson - has consistently approved Dyster spending plans that range from giving the state agency USA Niagara $1.5 million per year to stage parties and events on Old Falls St. and subsidize their management of the conference center, supported a governor’s contest for $4 million per year, to minor but endless little gifts to odds and bodkins such as $150,000 for a penguin habitat, and millions in gifts to various not for profits – some of whom are inactive and or course for various concerts.

While submitting to the state board may be a bitter pill for some to swallow, particularly the city’s unionized workforce, it may be toughest of all for Niagara Falls Mayor Paul Dyster, the financial genius who came up with the idea of counting savings in as revenue to begin with.

Surely no one with the slightest sense of fiscal responsibility would give the green light to harebrained schemes like the Holiday Market, canoe and kayak launches, a cricket field, the purchase of a science museum or the erection of a statue depicting a highly fictionalized historical figure with only the slimmest connection to the city?

Would the state Comptroller have permitted the sale of a prime piece of downtown real estate to do-nothing Buffalo developer Mark Hamister?

Once the restructuring board is here, the mayor will still be available for ribbon cuttings, restaurant openings and children’s birthday parties, but his days of deciding how the taxpayers’ money is to be spent will be over.